How to Identify Stock Trend Changes

Technical investors feel that following trends is an important aspect of investing and investors sometimes use complicated formulas to measure trends.

However, there is a way to simplify trend identification that gets to the root of how trends are formed: measuring highs and lows.

In this article, we’ll tell you how to identify trends using highs and lows, how to identify potential changes in trends, and how to use these changes in trends to help protect potential profits.

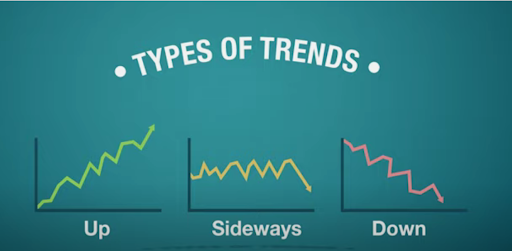

Uptrends, sideways trends, and downtrends are comprised of sequences of highs and lows. A stock generally doesn’t go straight up or down, but rather moves back and forth and produces support and resistance levels.

An uptrend is defined by the highs and lows forming higher and higher. In other words, each higher low could result in a higher high.

In a sideways trend, the highs and lows are equal. Each equal high should result in an equal low, until the sequence is broken.

And a downtrend is comprised of a sequence of lower highs and lower lows. Each point identified as a high or low becomes a benchmark for the next sequence of highs and lows.

Some investors monitor these highs and lows to anticipate changes in trends. This is an example of a stock in an uptrend based on rising highs and lows. The price has recently created a higher low and now might produce a higher high.

However, in this case, it failed to do so and has given a sign that something might be wrong with the trend because it didn’t do what was expected. Now the price has rejected the higher highs and broken below support, producing a lower low.

If an investor missed the first warning sign when it failed to produce a higher high, then this next warning sign should be a red flag that the uptrend is in trouble and likely starting a new downtrend.

Some investors miss the first warning sign and even worse, miss the second warning sign and enter or exit trades too late.

A way to avoid this risk is by learning to identify where the price may go under normal circumstances, and acting quickly when identifying abnormal moves. Consider moving out of a position when it fails to produce a higher high, rather than just waiting for support to break.

Here is an example of a trade that enjoyed an uptrend by consistently making higher highs and higher lows. The higher support level is a good sign, but then the trend weakens when it makes an equal high instead of a higher high.

This may be a good time to move out of the position and watch it closely to see if it can recover. After a few more days, however, the price dropped more and actually broke support to produce a lower low.

Here is a slightly different hypothetical example of a stock trading in an uptrend, but where an investor might expect a higher low, it sinks all the way down to an equal low at support.

This is the first sign that the sequence was broken, and the trend might be changing. After several days, it becomes clear that momentum is unable to push the price any higher and it makes a lower high.

Consider moving out of the position at this point, and maybe re-entering if the trend improves but for now the analysis indicates the trend is not strong enough to keep going. After several more days, it has dropped below support and started a new sequence of lower lows and lower highs.

An investor may want to re-evaluate their entry point, with the understanding that a downtrend may be reversing when the stock manages to break the cycle of lower highs and lower lows.

In this hypothetical example, the stock finally broke above a high, making a higher high. Generally, when a trend is broken, the price tends to come back and test the old resistance as new support. In this situation, some investors might consider waiting for a possible retest and establishing a position if a stock shows it can hold at a new higher low.

Also read: Axis Bank ACE Credit Card Review

Also read: Best Card For International Transactions India 2021

Also read: Citi Bank Paytm First Credit Card Review

Also read: Good reasons to use credit cards instead of cash

THANK YOU SO MUCH

Thanks for providing this valuable information and I have bookmarked it for future reference. Make a count of every minute with the DeskTrack Project Time Tracking Software for Employees to grow business. Hope you write again soon.

ReplyDelete